Table of Contents

2024 US Election: How Trump's Win Impacts Chinese Ecommerce Sellers

Time: Nov 11,2024 Author: SFC Source: www.sendfromchina.com

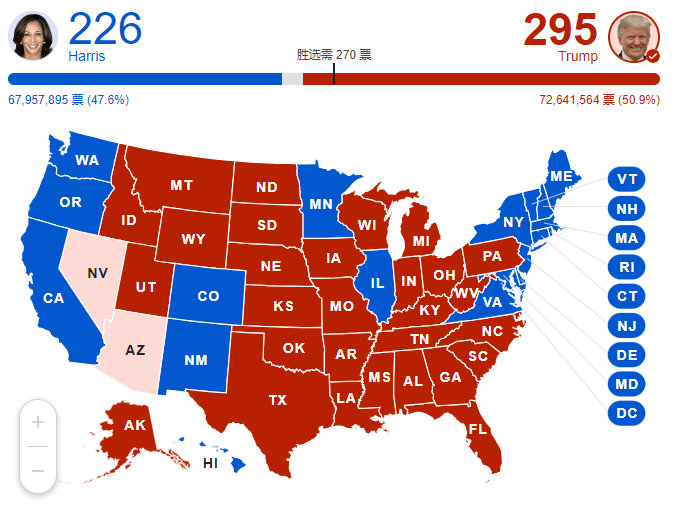

U.S. media widely regard the 2024 presidential election as the most closely contested in the country this century and possibly in the past 60 years. The 2024 election is a face-off between Harris and Trump. According to the final poll results released by AP News, Trump ultimately won 50.9% of the votes, while Harris secured 47.6%.

(Pic Source: APNews)

China e-commerce sellers closely watch the U.S. election, as its outcome will greatly influence the market in the coming years. Data from China’s General Administration of Customs indicates that from January to August 2024, China’s foreign trade remained robust, with a total value surpassing 28 trillion yuan, marking a 6% year-on-year increase. Exports reached 16 trillion yuan, with a growth rate nearing 7%. Notably, exports to the U.S. during this period totaled nearly 3 trillion yuan, representing about 18% of China’s total exports, reaffirming the U.S. as China’s largest export market. The demand for Chinese goods in the U.S. remains strong, and policy changes or exchange rate fluctuations are key considerations for cross-border sellers' strategies.

Many sellers have reported a sharp decline in order volumes over the past few days, likely due to election-related distractions as U.S. citizens prioritize the election over shopping. Sales are expected to gradually rebound in the coming days.

1. 2024 US President Election Timeline

January 15: The U.S. presidential election officially begins.March 12: Biden wins the Democratic primaries in Georgia and Mississippi.

May 15: Biden invites Trump to hold two in-person debates ahead of schedule.

May 30: Trump is charged with 34 counts of felony falsifying business records.

June 27: Biden and Trump participate in the first debate of the 2024 presidential election.

July 13: Trump is shot while giving a speech at a campaign rally.

July 21: Biden announces his official withdrawal from the presidential race.

August 5: Harris is officially nominated as the Democratic presidential candidate.

August 22: Harris formally accepts the Democratic presidential nomination.

September 10: Harris and Trump hold their first televised debate in Philadelphia.

November 5: Official voting for the U.S. presidential election takes place.

November 6: Trump wins the 2024 U.S. Election.

2. The Former Policy on Trump's Last Presidency

The Trump tariffs, often called the Trump-China trade war in the media, were protectionist measures implemented during Donald Trump's first term targeting Chinese imports. These tariffs were part of Trump's "America First" economic strategy, aimed at reducing the U.S. trade deficit by moving away from multilateral free trade agreements in favor of bilateral trade deals.

During Trump’s first term, U.S.-China relations faced significant turbulence due to the trade war. Trump became known for his aggressive tariff policies, crackdowns on Chinese tech companies, and repeated use of sanctions to curb China’s technological advancements. Between 2017 and 2021, his administration imposed substantial tariffs on Chinese imports valued at hundreds of billions of dollars, aiming to reduce the trade deficit and push for structural economic reforms in China. His return to politics suggests the potential resurgence of similar or even more stringent policies.

3. The Impacts of Trump's Win in 2024 on Chinese Ecommerce Sellers

Trump’s proposed trade agenda for 2024 signals a shift towards broad and aggressive protectionist measures aimed at reshaping U.S.-China economic relations. Unlike Biden's more targeted strategy, Trump’s approach focuses on sweeping tariffs to restore domestic manufacturing and reduce reliance on China. His plans include universal baseline tariffs on most imports, mechanisms for escalating tariffs on countries engaging in currency manipulation, and potentially removing China's most-favored nation (MFN) status, a move supported by some bipartisan groups but fraught with economic and diplomatic risks.

If implemented, these policies could severely impact Chinese exporters and strain U.S.-China relations. They would also likely increase costs for American consumers and businesses, damage the U.S. economy, and reduce its global trade standing. Trump's push for a four-year phase-out of essential Chinese imports, restrictions on U.S.-China investments, and banning federal contracts with companies outsourcing to China further underscore his commitment to reducing economic ties. His proposed Trump Reciprocal Trade Act would authorize reciprocal tariffs to counter foreign tariff imbalances, emphasizing a retaliatory approach to protect American interests.

Whether these ambitious proposals are serious policy intentions or campaign rhetoric remains uncertain. If pursued, they would require congressional approval and bipartisan support, which may be difficult to secure. Nonetheless, Trump’s aggressive stance points to a potential return of stringent and disruptive trade policies that could redefine U.S. economic relations with China and impact global trade dynamics.

4. Future Outlook: What’s Next for Chinese Ecommerce?

The U.S. election results could have significant impacts on businesses, including increased supply chain disruptions, market volatility, and a more unstable investment and regulatory environment. Regardless of whether Trump returns to office, U.S.-China relations are expected to remain tense. Both nations seek to address trade imbalances and reduce dependency on each other, leading to relatively similar risks no matter the election outcome. However, Trump’s approach may be more unpredictable, with broader trade policies potentially triggering another trade war. It remains uncertain, though, if he would follow through on these plans if elected.

Supply chain disruptions and market volatility are major concerns for businesses, particularly with the potential for new tariffs and countermeasures from China. Any escalation of military conflict in the Asia-Pacific region could further exacerbate these disruptions, resulting in severe instability and market chaos.

The investment and regulatory environment may also face challenges, with U.S. companies potentially caught in a diplomatic crossfire. However, it is noteworthy that China has not specifically targeted U.S. companies so far, but it has been working to attract foreign investment and improve the overall business environment for international enterprises.

5. FAQs

Q1: How will a Trump win impact tariffs on Chinese imports?

A Trump victory could lead to the reintroduction or increase of tariffs, driving up the cost of imported goods and affecting Chinese ecommerce sellers’ profit margins.Q2: Will Chinese ecommerce sellers need to change their supply chain strategies?

Yes, adjusting supply chain strategies by diversifying sources and optimizing logistics will be critical to mitigating potential disruptions.Q3: How can Chinese sellers remain competitive in the US market?

Focusing on product differentiation, local partnerships, and strategic pricing can help Chinese sellers maintain a competitive edge.Q4: Are there alternative markets Chinese sellers should consider?

Exploring markets such as Europe, Canada, and Southeast Asia can reduce dependency on the US market and open new revenue streams.Q5: What technological measures can help sellers adapt?

Implementing data analytics, automation, and supply chain management tools can help forecast disruptions and optimize operations. Post Views:159

Post Views:159

Copyright statement: The copyright of this article belongs to the original author. Please indicate the source for reprinting.

Previous Post

What Is Order Cycle Time & Why Is It Important?

Next Post

TAGS

Hot Research

Recent News

Get a Custom China Fulfillment Solution with FREE Storage for 30 Days

Want to know about our services, fees or receive a custom quote?

Want to know about our services, fees or receive a custom quote?

Please fill out the form on the right and we will get back to you within a business day.

Please fill out the form on the right and we will get back to you within a business day.

The more information you provide, the better our initial response

will be.

The more information you provide, the better our initial response

will be.

TAGS:

TAGS: